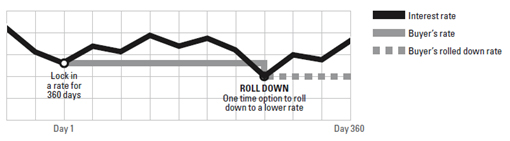

Extended rate lock1

When your clients are looking for new construction financing, we can help them purchase with confidence. With our mortgages, HSBC offers various extended rate lock options, up to 360 days. HSBC’s extended rate lock includes a rate roll down feature—a one-time option that allows clients to take advantage of lower rates, should they improve prior to closing.

Family Assisted Financing2

- A maximum of four borrowers are allowed to be considered owner occupied; the property must be the primary residence of one of the applicants.

- Everyone signing the note is considered a co-borrower and must be on the title.

- Cash out refinances are not allowed.

- All borrowers must meet standard requirements for mortgage eligibility, and must have either U.S. citizenship, permanent residence, or a valid visa acceptable to HSBC. Additionally, occupying borrowers with a valid F1 visa, are eligible for this program with documentation showing their current enrollment at a U.S. college or university.

| Condo Type |

Percent Complete |

Minimum Pre-Sale % |

Non-Residential Space |

HOA Control by Home Owners |

HOA Delinquency |

Financial Statements |

Single Entity Ownership |

HSBC Concentration |

|---|---|---|---|---|---|---|---|---|

| Established |

100% Complete |

90% |

<35% |

Required |

<15% |

Not Required |

<20% |

<33% |

| Non-Standard |

100% Complete |

Non-Standard A 51% |

>35% |

Not Required |

<10% |

Yes |

<20% |

<20% |

| Non-Standard |

100% Complete |

Non-Standard B 70% (and 30% of the units closed) |

<35% |

Not Required |

<10% |

Yes |

<20% |

<20% |

| New |

Not Complete |

30% |

<35% |

Not Required |

<10% |

Yes |

<20% |

<20% |

| Condo Type |

Established |

|---|---|

| Percent Complete |

100% Complete |

| Minimum Pre-Sale % |

90% |

| Non-Residential Space |

<35% |

| HOA Control by Home Owners |

Required |

| HOA Delinquency |

<15% |

| Financial Statements |

Not Required |

| Single Entity Ownership |

<20% |

| HSBC Concentration |

<33% |

| Condo Type |

Non-Standard |

| Percent Complete |

100% Complete |

| Minimum Pre-Sale % |

Non-Standard A 51% |

| Non-Residential Space |

>35% |

| HOA Control by Home Owners |

Not Required |

| HOA Delinquency |

<10% |

| Financial Statements |

Yes |

| Single Entity Ownership |

<20% |

| HSBC Concentration |

<20% |

| Condo Type |

Non-Standard |

| Percent Complete |

100% Complete |

| Minimum Pre-Sale % |

Non-Standard B 70% (and 30% of the units closed) |

| Non-Residential Space |

<35% |

| HOA Control by Home Owners |

Not Required |

| HOA Delinquency |

<10% |

| Financial Statements |

Yes |

| Single Entity Ownership |

<20% |

| HSBC Concentration |

<20% |

| Condo Type |

New |

| Percent Complete |

Not Complete |

| Minimum Pre-Sale % |

30% |

| Non-Residential Space |

<35% |

| HOA Control by Home Owners |

Not Required |

| HOA Delinquency |

<10% |

| Financial Statements |

Yes |

| Single Entity Ownership |

<20% |

| HSBC Concentration |

<20% |

Loans for Homebuyers

- Access to up to $5 million in financing on mortgages.

- Closing cost credits3 up to $1,500.

- Rate locks up to 360 days.

- Title vesting for U.S. corporations and U.S. limited liability companies4.

- International clients do not need U.S. credit history to be eligible to apply for a mortgage. HSBC may order an international credit history to help them obtain HSBC financing in the U.S.

- If homebuyers paid cash to expedite their condominium purchase transactions, we can assist them in getting some cash back, at favorable rates, when they apply for a cash-out5 refinance within six months of an all cash purchase.

Building Approval

- Approval valid for 24 months (new construction only)

Building Age (new construction only)

- Should not exceed 36 months since completion

Resources

We offer mortgage solutions for your international clients seeking a home in the U.S.6 Whether your client is looking for a new home to reside in or an investment property, HSBC is the right partner to make a home ownership a reality.

1 The minimum extended rate lock period is 90 days; extended rate lock is available in 30-day segments, up to 360 days (e.g. 90, 120, 150 days).

2 A maximum of four borrowers are allowed and at least one borrower must have a Premier7 relationship. The property being financed must be the primary residence of at least one borrower. Minimum FICO of 700 required, and options are available for international borrowers with qualifying documentation. Cash out refinances are not permitted. Please contact a Mortgage Consultant for specific details.

3 Must have a principal residence in the United States, U.S. Citizenship, or Permanent Residency to qualify for closing cost credit. For more information, please contact your mortgage professional.

4 The LLC or Corporation must be formed as a single purpose entity solely for the purpose of owning the subject property. Additional restrictions apply.

5 For reimbursement of an all-cash purchase, any loan(s) used as a source of funds to purchase the property (secured or unsecured) must be paid off; cash proceeds disbursed in connection with the new mortgage may be reduced accordingly.

6 International borrowers must have qualifying documentation to be eligible for an HSBC Preferred Mortgage, HSBC Deluxe Mortgage, HSBC Elite Mortgage or HSBC Summit Mortgage. Monthly mortgage payments must be made in U.S. funds.

7 For a complete list of HSBC Premier Relationship eligibility requirements, please visit https://www.us.hsbc.com/premier or speak with your Relationship Manager.

Deposit products are offered in the U.S. by HSBC Bank USA, N.A. Member FDIC

Mortgage and home equity products are offered in the U.S. by HSBC Bank USA, N.A. and are only available for property located in the U.S. Subject to credit approval. Borrowers must meet program qualifications. Programs are subject to change. Geographic and other restrictions may apply. Discounts can be cancelled or are subject to change at any time and cannot be combined with any other offer or discount.

United States persons are subject to U.S. taxation on their worldwide income and may be subject to tax and other filing obligations with respect to their U.S. and non-U.S. accounts. U.S. persons should consult a tax adviser for more information.