Fast, convenient and secure

The HSBC U.S. Mobile Banking app[@appinfo] lets you securely manage your accounts and view your investments offered by HSBC Securities (USA) Inc.* anytime, anywhere. This makes banking more convenient and gives you more time to yourself.

Using the app is easy, but if you need any help we're available 24/7 on the mobile chat feature.

Local and global banking in a flash

More reasons to get the app

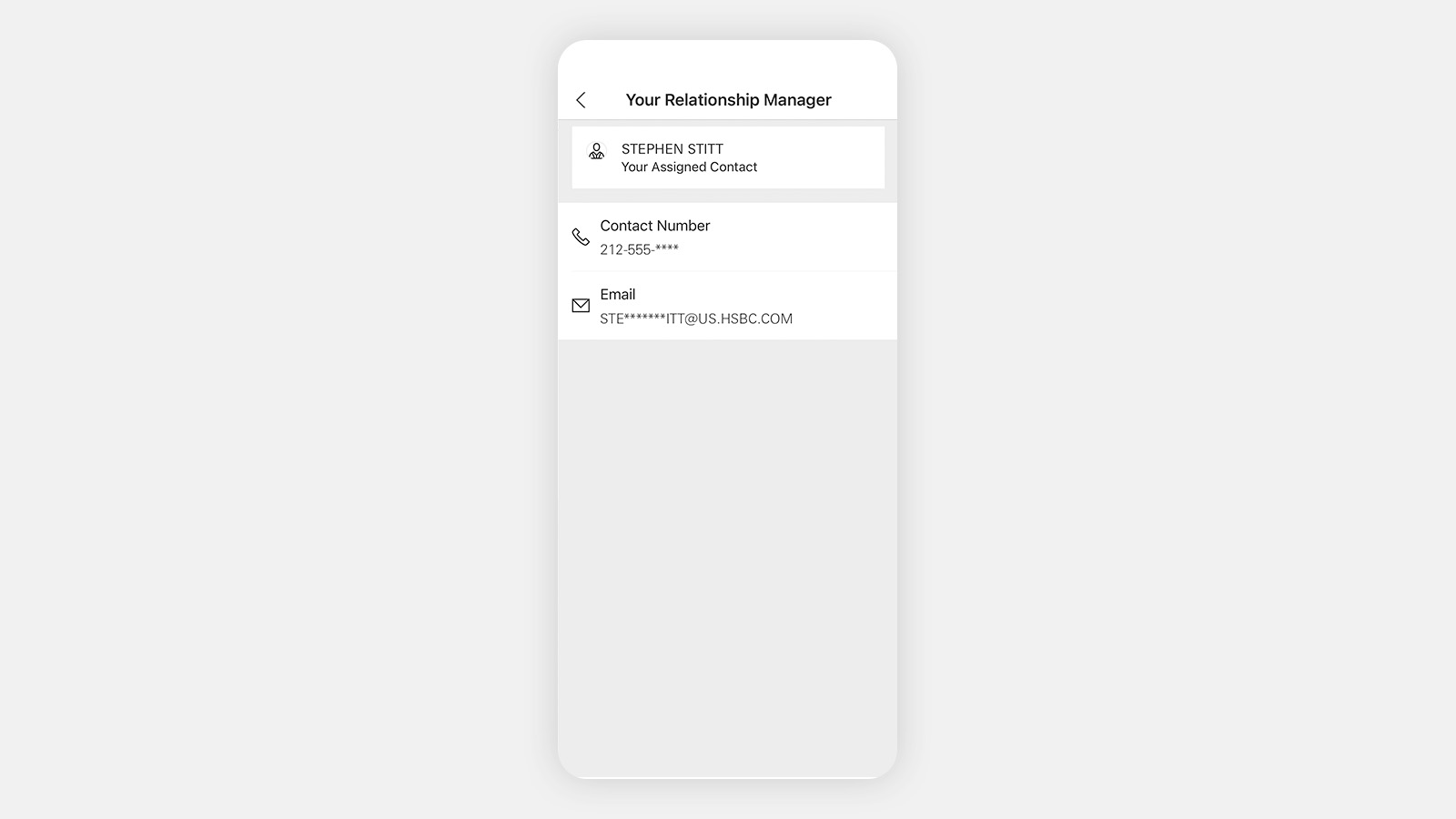

Get help to open an account

Provides contact details of your Wealth Relationship Manager who'll guide you through the application process.

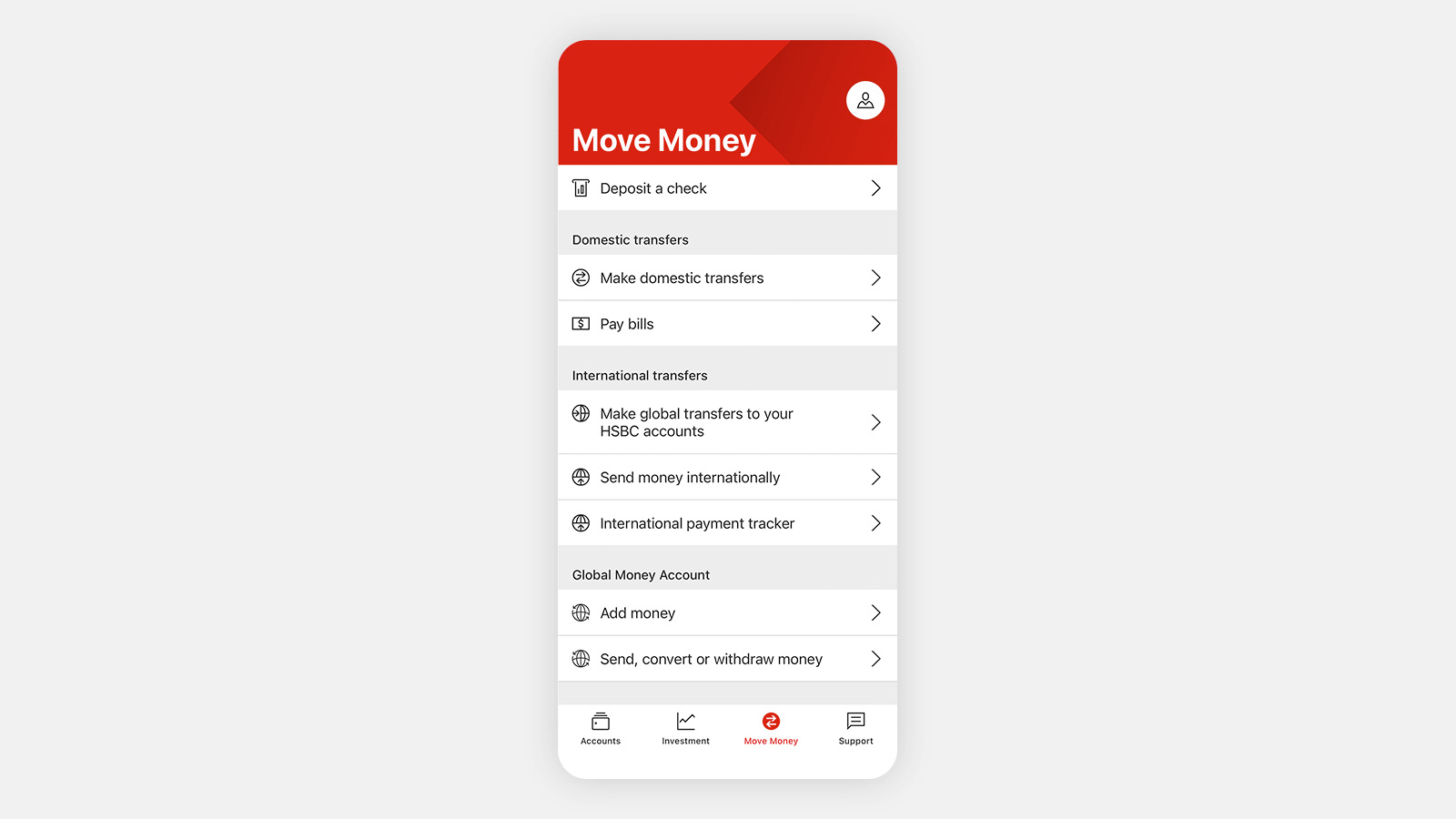

Make payments and transfers

Pay bills, make home and overseas payments, and transfer money between your linked HSBC global accounts.

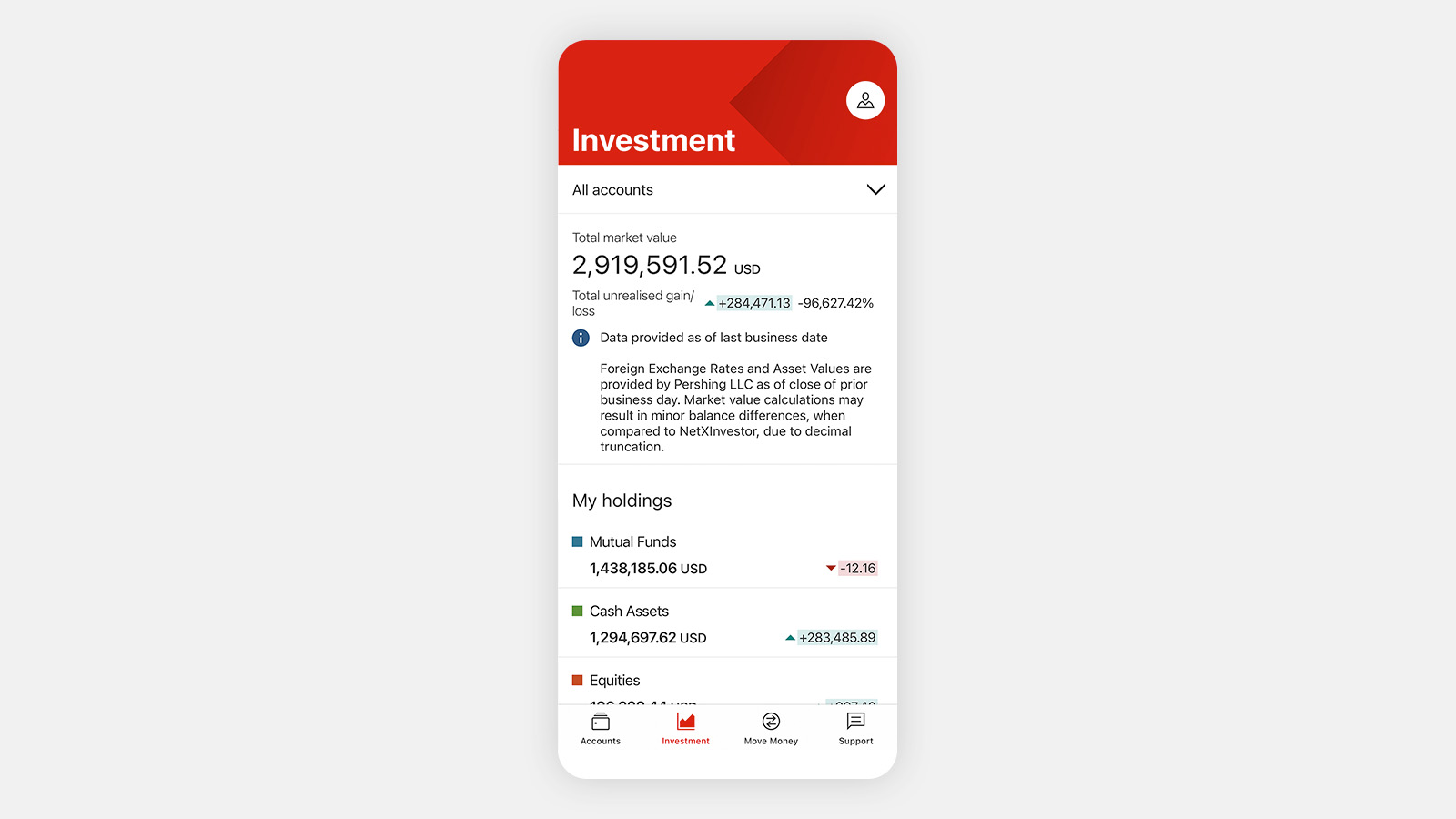

Check your investments

View your HSBC Securities (USA) Inc. investments including your portfolio and holdings information.

Access the world with one account

The 'app-only' Global Money Account[@globalmoneyacct] lets you hold and manage 8 currencies and make instant payments to HSBC accounts abroad.

For more than just everyday banking

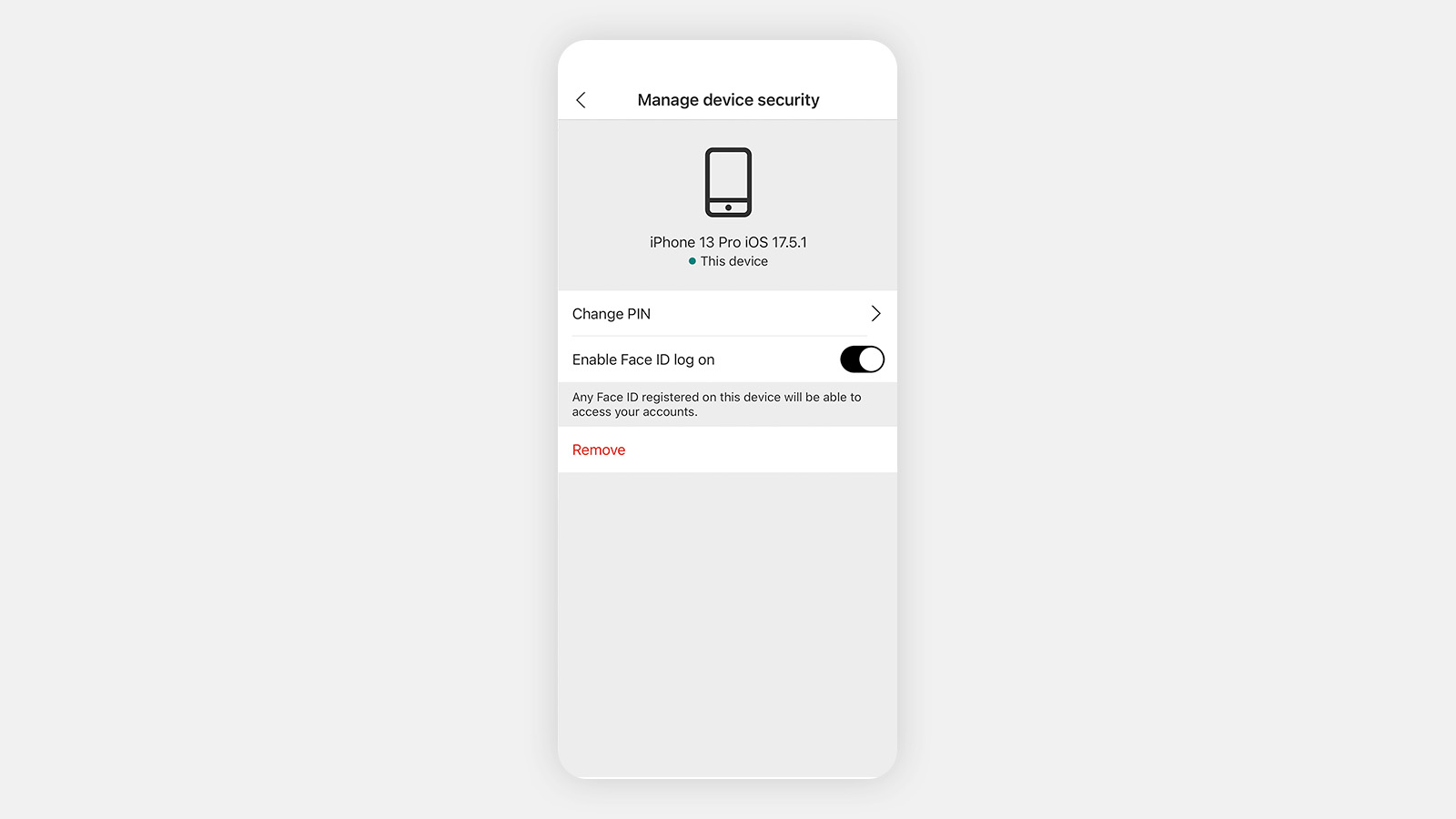

Security is our priority

We are constantly innovating to protect you and your money. Our app has a host of safety features:

- Digital Secure Device provides an extra layer of security

- Use your unique fingerprint for fast, safe access on AndroidTM devices with Fingerprint ID

- Use your unique fingerprint or face for fast, safe access on Apple® devices with Touch ID and Face ID

Download the app today

If you have an HSBC account, make sure you’re signed up for our fastest way to bank.Footnote link 3

Scan the code to download the app

If you have an HSBC account, make sure you’re signed up for our fastest way to bank.Footnote link 3